Xero Review 2025 – Key Features, Pros & Cons, and 90% XERO Discount Codes

Xero Review 2025

Xero offers a comprehensive suite of accounting, finance, and bookkeeping tools so entrepreneurs and small/medium-sized businesses can efficiently manage their financial operations from a single platform.

Searching for cloud-based accounting software to handle your bookkeeping, invoicing, payroll, and more?

Before committing, read our in-depth 2025 Xero review to determine if it’s exactly what your business needs.

It can be time-consuming juggling multiple finance tools. Xero aims to simplify your life by consolidating core accounting tasks—bank reconciliations, billing, payroll, and expenses—into one straightforward platform. The question remains: does Xero’s reputation (and its price) justify the investment?

For a short time in 2025, we’ve secured a special deal on Xero:

Get 90% OFF for the first six months when using the following partner link:

Highly Recommended

Xero

Xero is a complete, intuitive platform that makes tasks like invoicing, payroll, and expense tracking simpler than ever.

In this Xero review, we’ll explore its standout features, its compatibility with other services, and weigh up the pros and cons to see if it’s right for you.

If you’d rather jump in right away, use the link below to lock in the 90% discount for your first six months:

Table of Contents

What Is Xero Accounting Software?

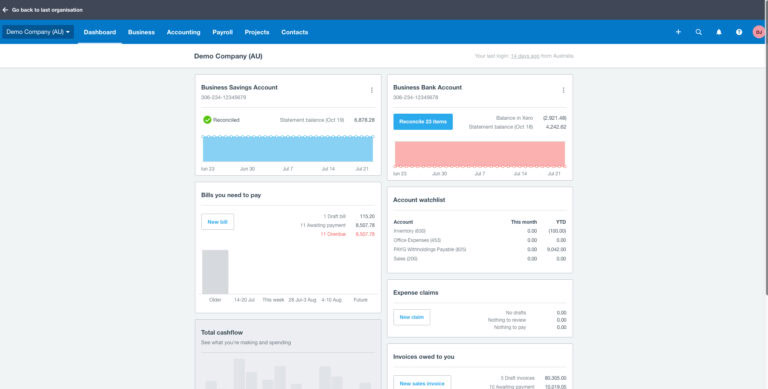

Xero is a cloud-based platform that centralises your accounting tasks—like invoicing, expense tracking, payroll (in certain regions), and real-time reporting—within a single dashboard accessible on any device. It’s designed to be user-friendly, even if you don’t have a background in bookkeeping.

Key features include:

- Automated bank reconciliation

- Customisable invoices and quotes

- Payroll integration (region-dependent)

- Multi-currency transactions

- Real-time dashboards and analytics

- Expense and inventory management

It also boasts a sleek mobile app for on-the-go financial updates and integrates with hundreds of popular business tools (e.g., Stripe, PayPal, HubSpot, Shopify), making it a versatile choice for many small to medium-sized businesses.

Xero Review: Key Features

1. Invoicing & Quotes

- Customisable Templates

Design unique invoices that suit your brand’s style. - Automated Reminders

Reduce late payments by scheduling invoice reminders at set intervals. - Quote to Invoice Conversion

Turn quotes into invoices instantly, saving admin time.

2. Bank Reconciliation

- Automatic Bank Feeds

Connect Xero to your bank account, and transactions are imported daily, ready for matching. - Real-Time Cash Flow Updates

View the status of your business finances at a glance from the main dashboard.

3. Expense Tracking

- Receipt Capture

Use the Xero app or a connected service (like Hubdoc) to scan and auto-categorise receipts. - Employee Reimbursements

Set up expense approvals and automate reimbursements.

4. Inventory Management

- Basic Stock Tracking

Xero updates item counts whenever you record a sale or purchase, keeping data current. - Deeper Integrations

Link advanced inventory systems for larger product catalogues or more specialised needs.

5. Payroll (Region-Specific)

- Built-In Payroll

Included for the UK, US, Australia, and New Zealand, offering direct tax filing, payslips, and pension contributions. - Third-Party Integrations

Connect with payroll services like Gusto if Xero’s native payroll isn’t available in your region.

6. Financial Reporting & Analytics

- Standard Reports

Generate profit and loss statements, balance sheets, and cash flow reports in seconds. - Custom Dashboards

Highlight essential KPIs—like unpaid invoices or year-over-year growth—for quick insights.

7. Multi-Currency

- Automatic Conversions

Manage payments and bills in multiple currencies with daily exchange-rate updates.

Ease of Use

Xero’s layout is built to guide you through accounting tasks. The main menu organises features (Invoices, Bills, Bank Accounts, etc.), while the dashboard provides a clear at-a-glance view of your business performance.

Mobile Functionality

Both Android and iOS apps are available, letting you create invoices or reconcile transactions anywhere. This flexibility is especially helpful for entrepreneurs who travel frequently.

Payments and Fees

Xero doesn’t add transaction charges for online payments; you’ll only pay fees to the integrated payment provider (e.g., Stripe, PayPal). Once your customer completes a payment, funds are deposited into your chosen account without delay.

Late Payments

Customise Xero’s automated reminder emails or add interest/fees to overdue invoices—handy for encouraging customers to pay on time.

Integrations

Xero stands out with its extensive app marketplace, offering everything from payroll add-ons to CRM connections. Popular integrations include:

- eCommerce: Shopify, WooCommerce

- CRM: HubSpot, Salesforce

- Payments: Stripe, PayPal

- Payroll: Gusto, Square Payroll

- Inventory: DEAR Systems, Cin7

Through Zapier, you can automate additional tasks, like importing data into Google Sheets or sending Slack notifications for new transactions.

Customer Support

- Xero Central

A thorough online resource with how-to articles, video tutorials, and community discussion. - Email Support

Send enquiries 24/7; typically answered within a business day. - Callback Requests

Instead of a direct phone number, you can arrange a callback for more complex questions. - Limited Live Chat

Available in some regions for quick support on routine issues.

Xero Pricing

Xero’s pricing (in most regions) breaks down into three main plans. Costs can vary based on your location:

- Early Plan

- Limited invoices, quotes, and bills

- Suitable for sole traders or freelancers

- ~£12/month (or local equivalent)

- Growing Plan

- Unlimited invoices, bills, and bank reconciliations

- Suits most small/medium-sized businesses

- ~£26/month (or local equivalent)

- Established Plan

- Multi-currency, advanced analytics, and project tracking

- Ideal for businesses with global or more sophisticated needs

- ~£33/month (or local equivalent)

Special Offer: For a limited time, use our exclusive link to get 90% off for 6 months.

Is Xero Right For Your Business?

Xero has become a leading choice for small and medium-sized businesses aiming for robust, easy-to-use cloud accounting. But is it the right one for you? Here’s a quick snapshot:

Choose Xero if…

- You need scalable accounting software that won’t become obsolete as you grow.

- You run a multi-currency or cross-border business.

- You value clean, modern UX and want to avoid complex accounting jargon.

- You aim to automate repetitive tasks (like invoice reminders and bank reconciliation).

Don’t Choose Xero if…

- You rely heavily on phone support (Xero offers only email and call-back).

- You need a desktop-based system, not a cloud service.

- You demand deep, specialised functionality beyond small/medium business scope (e.g., advanced manufacturing ERP).

- You’re on a shoestring budget and want a free solution (e.g., Wave).

Xero Alternatives

QuickBooks Online

A well-known competitor with strong market share, though some find Xero’s interface more straightforward and appreciate unlimited users.

FreshBooks

Easy for freelancers or service-based businesses, but lacks some advanced accounting capabilities of Xero.

FreeAgent

Well-liked by UK micro-businesses; best for sole traders or very small teams.

Sage Business Cloud Accounting

Part of the respected Sage portfolio, though many prefer Xero’s design and app ecosystem.

Xero Verdict

Overall, Xero is a feature-rich yet user-friendly accounting solution that has earned its status as a top contender. From automated bank reconciliations to multi-currency handling, it covers a lot of ground for small to mid-sized businesses.

Considering the 90% discount for six months, now is a prime time to give it a try and see if it fits your operations.

Likes

- Extensive feature set for invoicing, payroll, expenses, inventory

- Modern, intuitive interface suitable for non-accountants

- Large ecosystem of integrations

- Unlimited user access—no extra fee per user

- Strong multi-currency capabilities

Dislikes

- No dedicated phone line (callback only)

- Built-in payroll not available worldwide

- Early Plan restrictions can become limiting quickly

This post may contain affiliate links and we may earn commissions. Learn more in our disclosure.